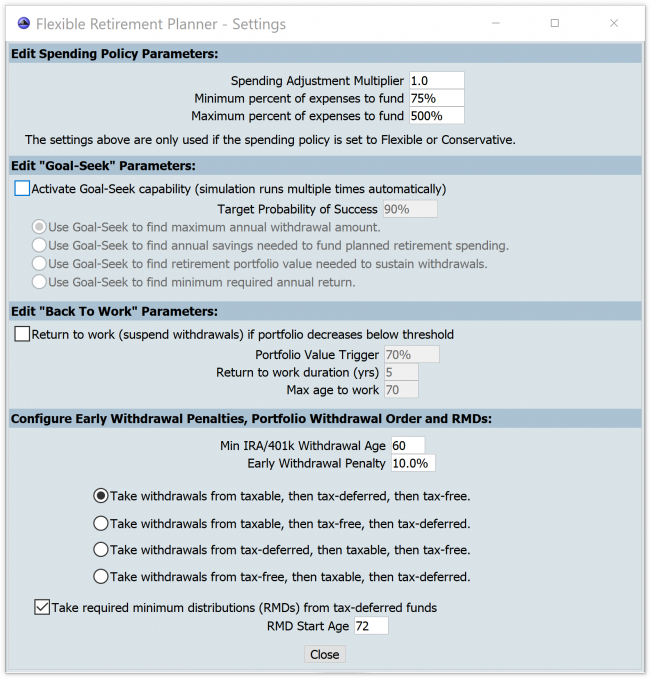

Settings Popup Window

There are some additional simulation parameters that you can adjust by clicking on the Settings button from the main planner window. When you click this button, a popup ‘Flexible Retirement Planner Settings’ window will appear.

Spending policy parameters

The first spending policy parameter is the Spending Adjustment Multiplier. Increasing this parameter magnifies the impact of the flexible and conservative spending policies, while decreasing it reduces their impact.

The next two spending policy parameters are the floor and ceiling values for the percent of expenses to fund. With these settings, you can control the upper and lower bounds for the simulation’s percentage of expenses to fund variable. This will constrain how much the simulation will let your actual spending (eg percentage of expenses to fund) deviate from your requested annual spending. For example, setting the floor to 75% ensures that in all simulation runs, the minimum amount of spending that will be funded is 75%. The only reason the funding can drop below this floor is if the portfolio runs out of money.

Goal-seek parameters

When this feature is enabled, it dramatically changes the way the planner works. With goal-seek enabled the simulation attempts solve for one of several typical retirement planning variables. There are some caveats that go with using goal-seek. The first is that you shouldn’t enter a probability higher than 99%. This is because goal-seek stops its search once it hits the target probability. Also, depending on other simulation inputs, there could be multiple solutions that give the same probability and goal-seek may not find the best one. Finally, although unlikely it’s possible for goal-seek to terminate without converging on a solution. If this happens, the simulation will return a probability of success that’s different from the target probability that you specified. To correct this situation, try setting a new starting value for either retirement spending or rate of return and run goal-seek again with the new search seed.

Back-to-work parameters

These parameters control a capability in the planner to model what would happen if you return to work when a dramatic drop in your portfolio’s value occurs. Some research indicates that returning to work for a few years following extended periods of portfolio under performance can have a big impact on your retirement plan’s chances for success. To activate this capability, click on the checkbox. The Portfolio Value Trigger is a threshold value that controls when the back-to-work scenario is invoked. In any year following retirement, if the portfolio value falls below this percentage of its value at retirement start, withdrawals from the portfolio are suspended for the number of years specified in the Return to work duration setting. Next, there’s a Max age to work setting to limit the age you might have to work until. The results table at the bottom of the main display shows the probability of having to return to work based on this capability.

There are three caveats about how this back-to-work feature works. The first is that the back to work logic assumes that returning to work will cover all of your expenses during the years worked. Portfolio withdrawals during the back to work period are fully suspended. The second caveat is that only one back-to-work event will occur in each simulation iteration (for the duration you specify) no matter how many times the portfolio dips below the threshold. The final caveat is that if the back-to-work portfolio threshold is crossed in a year when your age + the back-to-work duration is greater than the Max age to work, the back-to-work logic will not be invoked.

IRA Withdrawal Penalties, Withdrawal Order and RMD’s

The Min IRA/401k Withdrawal Age input controls the minimum age for penalty free IRA/401k withdrawals. If any withdrawals are required from tax deferred or tax free accounts before the minimum age is attained, income taxes and a penalty are deducted from the withdrawals. Generally, the default setting of age 60 should only be changed in carefully considered, atypical, planning scenarios, including cases where tax laws may be different from those in the United States.

By default, withdrawals are taken from the taxable portfolio first, then tax deferred once the taxable portfolio is depleted, then tax free once the tax deferred portfolio is depleted. This allows tax deferred and tax-free funds to grow unhindered by taxes during the early years of retirement. This setting can be used to change the default withdrawal order.

A final option can be configured to cause the simulation to take Required Minimum Distributions (RMDs) from IRAs and other tax-deferred accounts. When this option is selected, the simulation will withdraw the minimum IRS specified withdrawal percent each year starting in the year the retiree reaches the “RMD Start Age” which defaults to age 72. RMDs are based on IRS published life expectancy table. The funds from the withdrawals are used to pay expenses (and taxes) and any remaining funds are transferred to the taxable portfolio, after taxes are deducted.